Free Czech Payroll Basics Guide – 2025 Edition

Introduction

Payroll in the Czech Republic may look complicated at first glance — with multiple types of contracts, statutory deductions, tax credits, and reporting duties. Yet it follows a clear structure defined by national law.

This guide gives you a straightforward overview of the basics:

- how salaries are paid and taxed

- what contributions both employees and employers must make

- what rights employees have in terms of leave and minimum wage

- and which obligations employers must follow

It is designed for:

- Employers who are new to the Czech market and need a quick orientation

- Employees who want to understand how their payslip is calculated

- International companies with staff in the Czech Republic who need to understand local payroll rules

Important note: This is a free introductory guide, not a full legal manual. It gives you the essentials to navigate Czech payroll with confidence. For detailed rules, step-by-step calculations, templates, and compliance checklists, see our Payroll in the Czech Republic: Practical Handbook.

Looking for tailored advice, a payroll health-check, or hands-on help with Czech legislation? Book a consultation with our payroll experts and make sure your operations stay compliant and efficient.

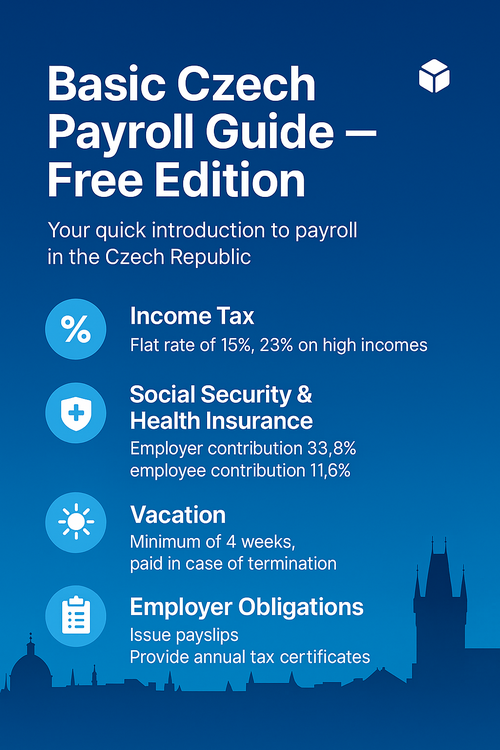

Quick Payroll Facts

- Currency: Czech koruna (CZK)

- Pay frequency: monthly (by law, wages must be paid no later than the end of the following month)

- Main statutory deductions (2025):

- Income tax: 15% up to CZK 139,671/month, 23% above

- Social security: 7.1% employee + 24.8% employer

- Health insurance: 4.5% employee + 9% employer

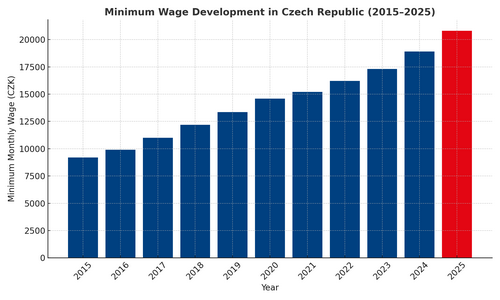

Minimum & Guaranteed Wage

- Minimum gross wage 2025: CZK 20,800/month

- Guaranteed wage: higher minimum levels for specific job categories (e.g. administrative, technical, professional).

Minimum Wage Development

👉 Ready for the full picture? Get the complete Czech Payroll Guide — your roadmap to payroll compliance in Czechia.

Get the Czech Payroll GuideTypes of Employment Contracts

- Full-time employment (HPP): standard 40 hours/week, full contributions.

- Agreement on work activity (DPČ): up to 20 hours/week; insurance applies if monthly income > CZK 4,500.

- Agreement on work performance (DPP): max 300 hours/year with one employer; insurance applies if monthly income > CZK 11,500.

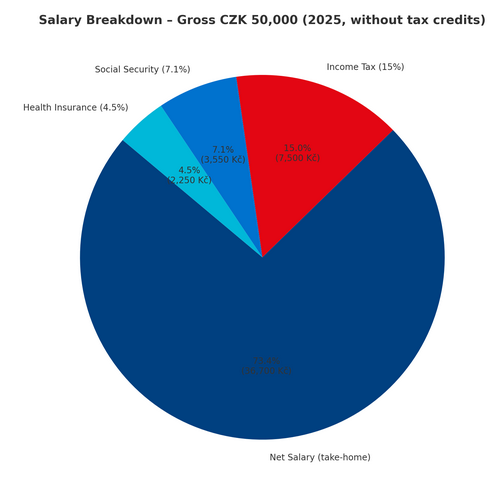

Net Salary Example

Understanding how gross salary is transformed into net take-home pay is one of the most common questions for employees in the Czech Republic. While the gross amount is written in the employment contract, the actual money on the employee’s bank account is always lower due to mandatory deductions. This example shows a standard calculation for 2025 with a gross monthly salary of CZK 50,000. It illustrates how income tax, social security, and health insurance reduce gross pay and how much the employee finally receives.

Example: Net Salary Calculation (without tax credits)

Gross monthly salary: CZK 50,000

- Step 1 – Income tax

15% of gross salary = CZK 7,500 - Step 2 – Employee social security

7.1% of gross salary = CZK 3,550 - Step 3 – Employee health insurance

4.5% of gross salary = CZK 2,250 - Step 4 – Net salary

Gross: 50,000 - Minus income tax: –7,500

- Minus social security: –3,550

- Minus health insurance: –2,250

Net salary = CZK 36,700

Note: This calculation is for a Czech tax resident in 2025, with income under the 23% tax bracket and no tax credits applied.

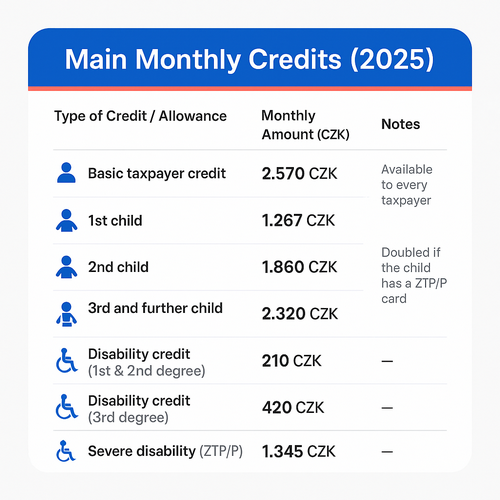

Tax Credits in the Czech Republic

Employees in the Czech Republic can reduce their income tax liability by applying monthly tax credits.

Note: Tax credits (basic, child, disability) can only be applied if the employee has signed the “Prohlášení poplatníka daně z příjmů” (Declaration of the taxpayer for income tax). Without this signed declaration, the employer cannot apply the monthly tax credits. Some tax credits (e.g., spouse, mortgage interest, donations) are applied only annually.

Vacation & Public Holidays

- Statutory vacation: minimum 4 weeks (20 working days) per year.

- Many employers offer 5 weeks.

- Public holidays are additional and fully paid (if falling on a workday).

Annual Tax Reconciliation

- Conducted at the end of each tax year (January–December).

- Employers can do it for employees (if requested by February 15).

- Takes into account yearly income, tax prepayments, deductions, and allowances (e.g. children, spouse, mortgage interest).

Employer Obligations at a Glance

- Register employees with health insurance and social security.

- Submit monthly reports to authorities (by the 20th of the following month).

- Issue payslips and maintain payroll records.

- Provide annual income certificates to employees.

Sick Leave & Sickness Benefits

- Days 1–14: Employer pays wage compensation at about 60% of a legally reduced average earnings.

- From day 15 onwards: Sickness benefits are paid by the Social Security Administration (ČSSZ), usually around 60–72% of a reduced base, depending on the duration.

- Sick leave benefits are tax-free and not subject to employee social security or health insurance contributions.

Maternity & Parental Leave

- Maternity leave: 28 weeks (37 for multiple births), benefit = 70 % of assessment base.

- Parental leave: can last up to 3 years of child’s age; allowance paid by Labour Office.

- Both are funded by Social Security, not the employer.

Severance Pay

- Mandatory if employment is terminated for organizational reasons (redundancy, closure, restructuring).

- Length of service determines entitlement:

- less than 1 year = 1 month’s average earnings

- 1–2 years = 2 months

- more than 2 years = 3 months

- Taxable, but not subject to social & health contributions if statutory entitlement.

Digital Reporting & Compliance

- Employers must submit reports electronically (via datová schránka or payroll software).

- Key filings:

- Monthly social security & health insurance reports (due 20th).

- Annual income tax settlement.

- Sickness & maternity documentation (eNeschopenka system).

- Non-compliance can lead to penalties from the tax office or ČSSZ.

Outlook for 2026

From 2026, several important changes will affect Czech payroll. Employers should monitor these developments and prepare their HR and payroll processes in advance:

- Uniform monthly employer report: will replace multiple filings to different authorities. This brings simplification but also higher demands on data accuracy.

- EU Pay Transparency Directive: must be implemented by June 2026. Employers will be required to include salary ranges in job ads and report on gender pay gaps.

- Labor Code & tax law amendments: further changes are expected, e.g. treatment of stock options, R&D allowances, and other compliance areas.

👉 Ready to go beyond the basics? Get the complete Czech Payroll Guide 2025.

Get the Czech Payroll GuideFrequently asked questions

- Do employees get meal vouchers in the Czech Republic?

Many employers offer meal vouchers or a cash allowance for meals. It’s not mandatory, but it is a common benefit. - How often are salaries paid?

At least once per month. By law, salary must be paid no later than the end of the following month. - Can an employee have more than one job in the Czech Republic?

Yes, but only if it doesn’t violate a non-compete clause. A second job must also respect working time limits. - Do probationary periods exist?

Yes. After the flexi-amendment (from 1 June 2025), the maximum probationary period is 4 months for regular employees, and 8 months for managerial roles. - Are bonuses guaranteed?

Only if they are written in the contract or internal policy. Otherwise, bonuses are discretionary.

- Is remote work regulated by law?

Yes. Remote/work-from-home setups must be agreed in writing, and the employer is generally required to reimburse certain work-from-home expenses (such as internet, electricity, heating) either by actual costs or by a lump-sum allowance. - How is parental leave handled?

After maternity leave, parents can take parental leave up to the child’s 3rd year. They receive a parental allowance from the state. - What happens if an employee doesn’t use all vacation days?

Unused vacation is carried over to the next year. It should normally be taken within 12 months, and the employer is responsible for scheduling it. - Is it common to have a 13th salary in the Czech Republic?

Not required by law, but some employers offer it as a benefit, often paid at year-end. - Are trade unions active in the Czech Republic?

Yes, some companies have unions that negotiate collective agreements, especially in manufacturing, transport, and healthcare.